💰Fees

Our fees are essential for covering the expenses required to run StackMining, in partnership with Mining Automatic, to provide institutional mining infrastructure & returns to our NFT holders.

Fee Breakdown

We have a simple 80/20 split on the mining rewards. 20% of the mining rewards go to SteadyStack, and our partners at MiningAutomatic, as a service fee for managing, scaling and maintaining the infrastructure of our mining pool.

In addition to this, we just have a 10% upfront "haircut" fee on investments into StackMining that is channeled towards setup, administration, and scaling.

That's it! Our Mining-As-A-Service (MaaS) partnership with Mining Automatic provides enterprise-level crypto mining infrastructure to our NFT holders for a simple 20% management fee and 10% upfront "haircut" fee.

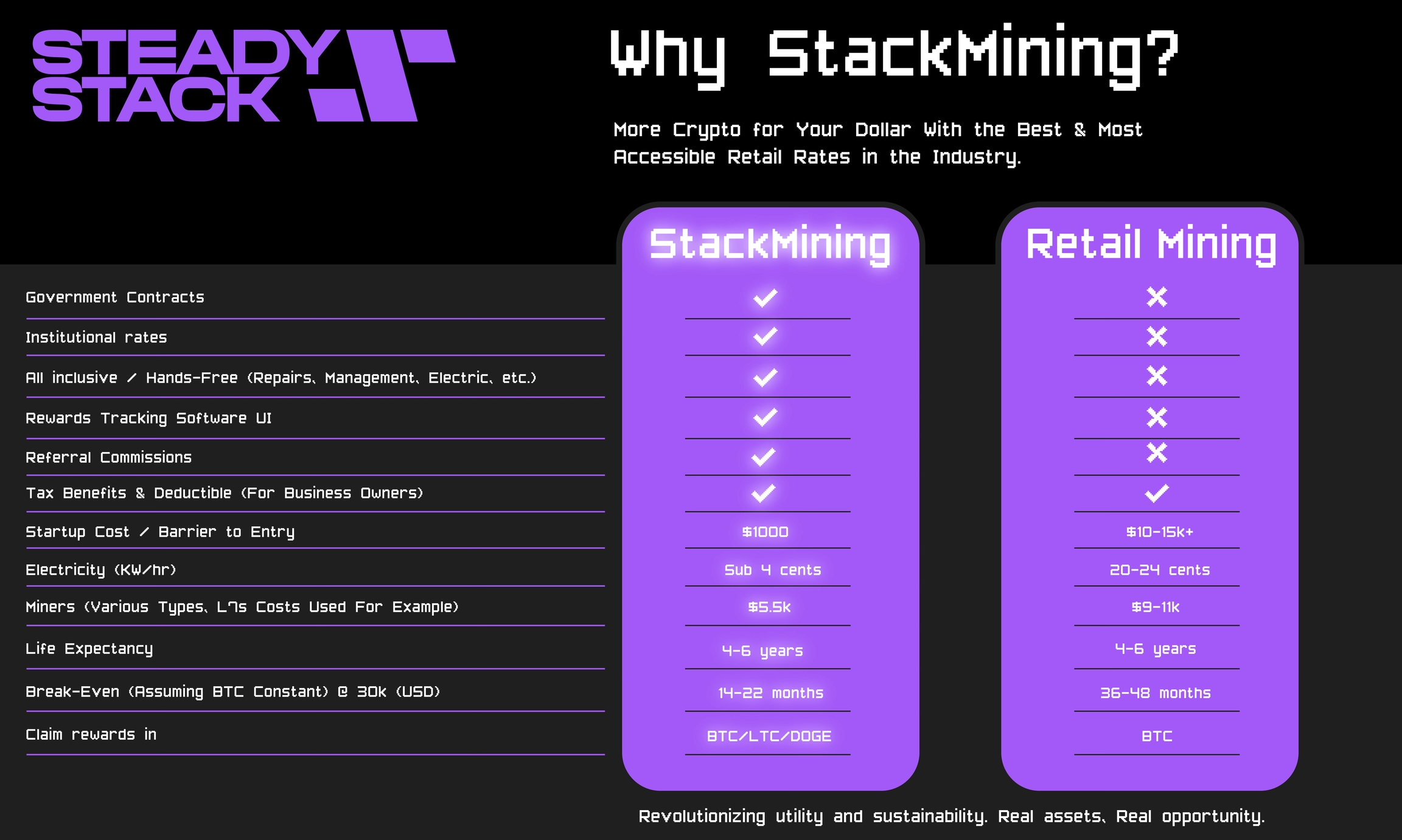

Comparison to Other Mining Pools

Bitmain: a dominant payer offering returns around 30%, and energy costs of $0.06 per Kilowatt Hour, takes a 30% management fee from investors.

Hive Blockchain: While they advertise returns of 33 - 43%, they levy a 15% setup fee and claim 25% in profit sharing.

Core Scientific: Multi 9-figure publicly traded mining institution, offering energy rates starting at $0.085 per Kilowatt Hour.

Most opportunities require larger minimums, and must pay for CapEx & energy deposits which are waived with StackMining

In this context, StackMining's unique dual-facility advantage, competitive energy rates, easy of entry, and investor-centric revenue model stands out as a disruptor in the crypto mining landscape.

How Are Mining Rewards Distributed With StackMining?

Mining rewards are automatically distributed to StackMining clients bi-weekly or monthly (depending on the mining pool) in proportion to your share of the mining pool, so long as you meet the minimum payout threshold.

For Bitcoin, the current minimum payout threshold is $200 to avoid burning profits with excessive gas fees.

However, for other coins such as $KASPA, that have transaction fees in the pennies, we can accommodate much lower payout thresholds.

ℹ️ We are currently working on a real-time mining dashboard, which should launch in Q1 of 2024, and allow StackMining users to claim their rewards once minimum thresholds are met.

Can You Reinvest Your Mining Rewards?

Yes! While the upfront 10% "haircut" fee will still apply, because there are no gas fees involved in reinvesting your rewards, you can reinvest any amount of your rewards into the StackMining pool with no transaction fees! The compounding feature will be available on our StackMining dashboard scheduled to launch Q1 of 2024.

How Long Do Payouts Last For?

Payouts duration depends on how long the mining equipment lasts which can be anywhere from 3 - 6 years. Typically on the longer side. We expect the StackMining pool to payout dividends to each investor for 5 years from the date of each investment.

What Forms Of Payment Do You Accept And Payout With?

You can make investments into the StackMining pool in the form of USDC or USDT on the ETH blockchain.

The mining rewards paid out to StackMining users depends on the pool they choose to invest in. If in a Bitcoin pool, users will receive rewards in Bitcoin. If in a Litecoin pool (for example), users will receive rewards in Litecoin.

If you need help facilitating an OTC transfer or receiving rewards in another form of payment, that feature will also be available in our StackMining dashboard scheduled to launch Q1 of 2024.